Whichever industry we fall into, the key business and profitability indicator is always looked up-to the Revenue generated and gained for the period.

Different business, different types of revenue and with this comes in the added responsibility of recognition of revenue.

To have a uniformity of reporting revenue across business lines, comes the requirement of having an international reporting standard in place.

Thus, for Revenue it is ASC 606 – a single comprehensive model for entities to use in accounting for revenue arising from contracts from customers.

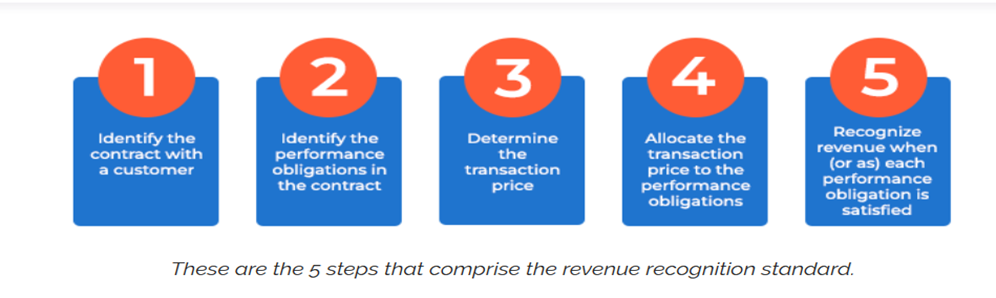

This ASC 606 is a 5-step model making revenue recognition and allocation more streamlined and effective for stakeholders to trust the business and skip from fraudulent business practices of revenue inflation.

ASC 606 –The Five Step Model

Step 1 – Identify the contract with the Customer

ASC 606 defines contract to be any form of agreement between two or more parties that creates enforceable rights and obligations between them.

This emphasizes the contract to have min 2 identifiable parties where the monetary payment terms are identifiable on exchange of goods/services as determined.

Any change in price or scope of this contract leads to creation of a new contract between the parties.

Step 2 – Identify the Performance Obligations in the Contract

Identify what calls for completion of service against the order generated by the customer.

It could be actual delivery of goods, completion of training activities for the staff post-delivery or it could just be an actual dispatch of goods irrespective the delivery of goods happened or not.

First understand and identify the deliverables and second whether each deliverable should be considered separate or not.

Determine this with the customer what calls a completion of service and mention the same exclusively in the contract.

Step 3 – Determine the Transaction Price

The transaction price is the amount of consideration (e.g. payment or contract revenue) to which a reporting organization expects to be entitled to in exchange for transferring promised goods or services to a customer. This amount excludes third party obligations like sales tax.

However, it should take into consideration discounts, incentives, rebates and other price concessions.

Step 4 – Allocation of Transaction Price As per the Performance Obligation

This is a real accounting step whereby all the first three steps are put into effect, and we allocate the Transaction price as per decided in the performance obligations.

This step is all about mapping fair values to your goods/services exchanged as per the contract in your books of account.

Step 5 – Recognition of Revenue

Revenue is reported when or as it satisfies the performance obligation by transferring the promised goods or service to a customer. Obligations can be satisfied point-in-time or overtime as per what is agreed by the parties to the contract.

Hence amount of revenue recognized in a period = value of services obliged at that stated period.

Thus ASC 606 is an evidence-based reporting standard providing accuracy on amount timing and uncertainty of revenue and related cash flows.

It clearly outlines contracts for how organizations must recognize revenue leading to better SOX compliance across industries including public, private and non-profit entities.